How to get a cryptowallet : Our guide

In the world of currencies and stocks, Bitcoin has emerged as a curious novelty. A completely digital currency, with no physical equivalent. Also, the nature of cryptocurrencies does not allow you to store them under your mattress or bank account. However, you can store your access to your coins, which are in the form of private keys. We call this "storage" crypto wallet, or crypto wallet.

Remember that, even if we use the term wallet, your cryptocurrencies are not stored there strictly speaking. Moreover, they never leave the blockchain. It is rather a more or less secure storage of your private key, because the blockchain knows at all times how much is assigned to each key. Here you will find a guide that details the different wallets and how to use them.

Note that in this guide, the terms wallets and wallets will be used, but refer to the same thing. Since the world of cryptocurrency is made up of English terms, it is important to know them and immerse yourself in them.

A crypto wallet? What for?

Cryptos use public and private keys to secure transactions and these are generated when a wallet is created. The wallet creates the public keys that are a derivative of the private key, and they are used as addresses to receive currency (and only receive). In fact, the private key is the one that proves that you are the owner of the currencies contained in the said public keys which allows you to use your currencies.

You should know that if you are not the only one in possession of your private key, we can admit that the currencies stored there do not belong to you. In other words, if an exchange platform or web wallet holds your funds (and therefore potentially your private key), you do not directly control your funds. You thus bequeath the responsibility of your currencies and their security.

In this sense, crypto regulars symbolically say "not your keys, not your bitcoins" which will be translated as "if they are not your keys, they are not your bitcoins" in order to illustrate this idea. Being the only person holding your keys ensures that your funds are not seized or stolen. The goal of this guide is to familiarize yourself with these concepts and help you choose the most suitable method of storing your keys for you. Note that we highly recommend using multiple forms of wallet at once!

The different types of wallets

Let's start by establishing the different wallets you can use. Each of them has advantages as well as disadvantages, as well as varied features. We will put them into two broad categories, cold storage and hot wallets.

Cold storage

Mind wallet

Using a mind wallet means learning your private key by heart. This is technically the safest method since there is no trace, but probably the most dangerous since you will depend 100% on your memory. A long period without using your key or a bad blow to the head (which we obviously do not wish you) are strong enough arguments to dissuade you from using this risky method.

USB flash drive

You can also use a USB flash drive as a way to save your private key, as a text file. However, note that even if you put your USB drive safe, this method is not without risk. This is because saving the file could leave residual traces of your key in the temporary files of your operating system. As long as your computer harbors a virus, your key could be exploitable.

Your good old USB key

Hardware wallet

Hardware wallets have been developed specifically to store private keys. It is roughly a USB stick for cryptocurrencies.

Strictly speaking, it is a mixture of cold storage and hot wallet (which we will see below). This type of wallet has two great advantages, especially when compared to the USB key. First, your private key is stored in a protected area and cannot be read in plain text as long as the wallet is connected to the computer. Viruses or other malware cannot reach it. In addition, they are usually distributed with software that allows you to make cryptocurrency transfers, like web wallets.

In addition to their advantages, hardware wallets have two disadvantages. The first will be that not all cryptocurrencies are necessarily supported, even if a large part of the most popular digital currencies are, such as Bitcoin or Ethereum. The second will be its price. Where many online wallets are free, hardware wallets remain hardware and therefore generate a cost. An interesting investment for anyone who wants to combine safety and practicality.

Here are some models we recommend:

Trezor Model T and Ledger Nano X hardware wallets

Paper wallet

This type of wallet is actually a simple piece of paper. Whether printed or even handwritten, it will contain your private key to access your funds. It is the simplest and oldest of the "cold wallets". Its greatest strength, beyond its simplicity, is that it is inviolable by viruses for example. For this reason, we prefer the handwritten version, the printing of the said key necessarily passing through the sending of a file to the printer … You understand the idea, as for the USB key method, we would tend to stop at "you never know".

However, this support has some limitations. A key on paper is inherently fragile and easy to lose. In addition, it adds an extra step to accessing your funds, since you will have to type your key each time beforehand. A price to pay for increased security.

Physical Bitcoin

A physical Bitcoin comes in the form of a coin or an ingot that contains a public address and a hidden private key, as well as a defined amount of bitcoins. This key and a QR code are located on a sticker, the private key being impossible to see unless it peels off. To ensure that the key has not been leaked, the sticker contains a holographic pattern that changes once it has been removed even once.

Casascius LLC, based in Utah, USA, was the first to introduce this concept. The author of the project, Mike Caldwell, had the idea of giving an aesthetically pleasing physical support to the virtual currency. This form of crypto would then allow them to be collected, used as a means of payment or as a gift. It was also about giving a palpable form to the cryptocurrency in question, which was (and still is) too little understood by the majority.

Mike Caldwell will however stop the production and sale of these objects in 2013, the American justice stressing the illegal nature of his project that is to say the production and distribution of a potential parallel monetary system. The dollar must keep its place.

These objects are still in circulation today and their price is also higher than their Bitcoin content and their equivalence in € / $.

Hot wallets

Desktop wallet

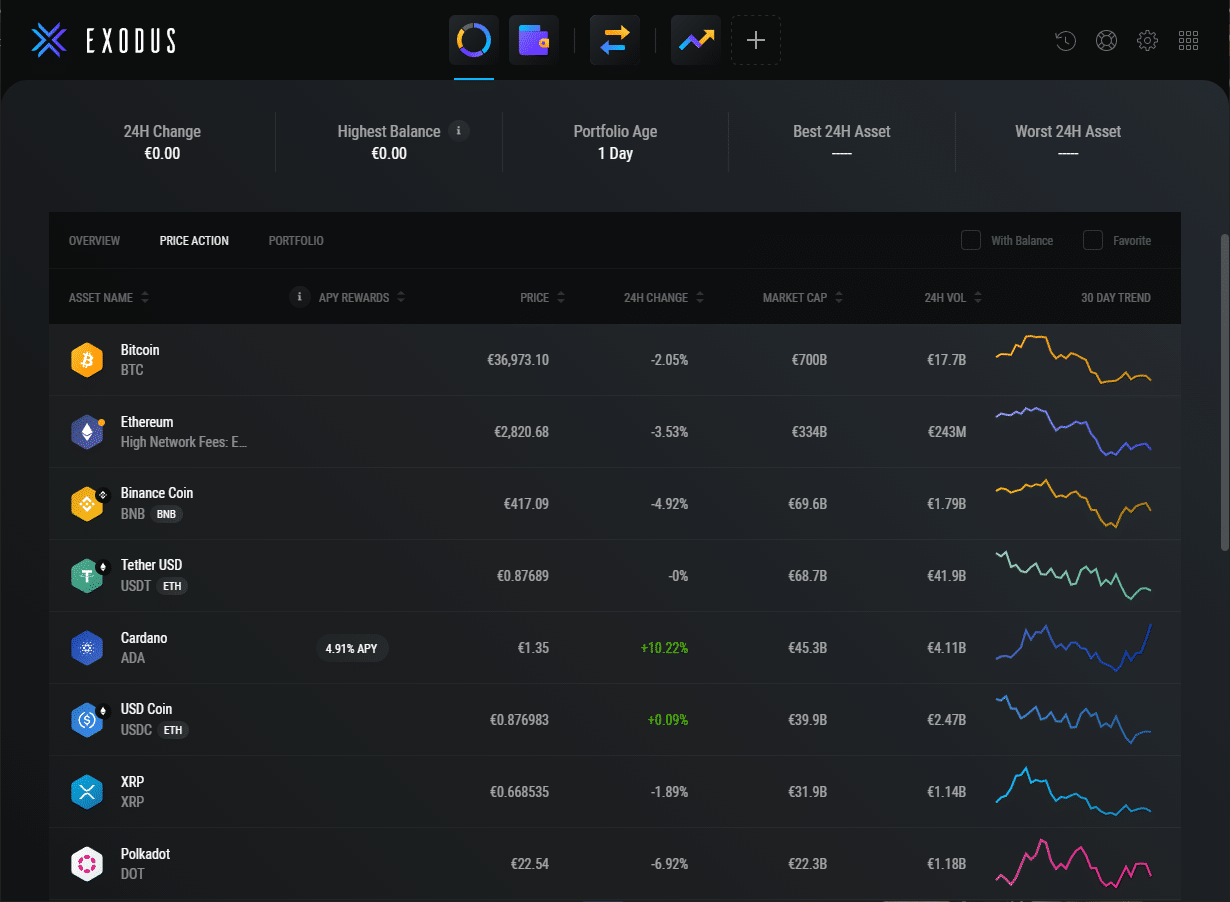

Desktop wallets are programs installed on your computer that store your private keys. They are similar to ergonomic interfaces that display, for example, your balance and allow you to make transactions.

Desktop wallets are easy to set up and use, and have regular updates. Using them does not exempt you from making a backup of your keys, because you could always access your corners if your computer were to crash. Note that some desktop wallets support connecting to a hardware wallet we talked about above. Practice!

These wallets are constantly connected to the internet, however, you must be careful to keep a clean computer to avoid hacking. A desktop wallet is as secure as the computer on which it is installed.

Some examples of desktop wallets:

Mobile wallet

A mobile wallet is an application that, like the desktop wallet, allows the user to manage their crypto funds with a mobile device such as a smartphone or tablet. They are usually available for Android or iOS systems. This type of wallet is very suitable for people who move regularly. It should be added that "mobile" wallets are also as secure as the systems that house them.

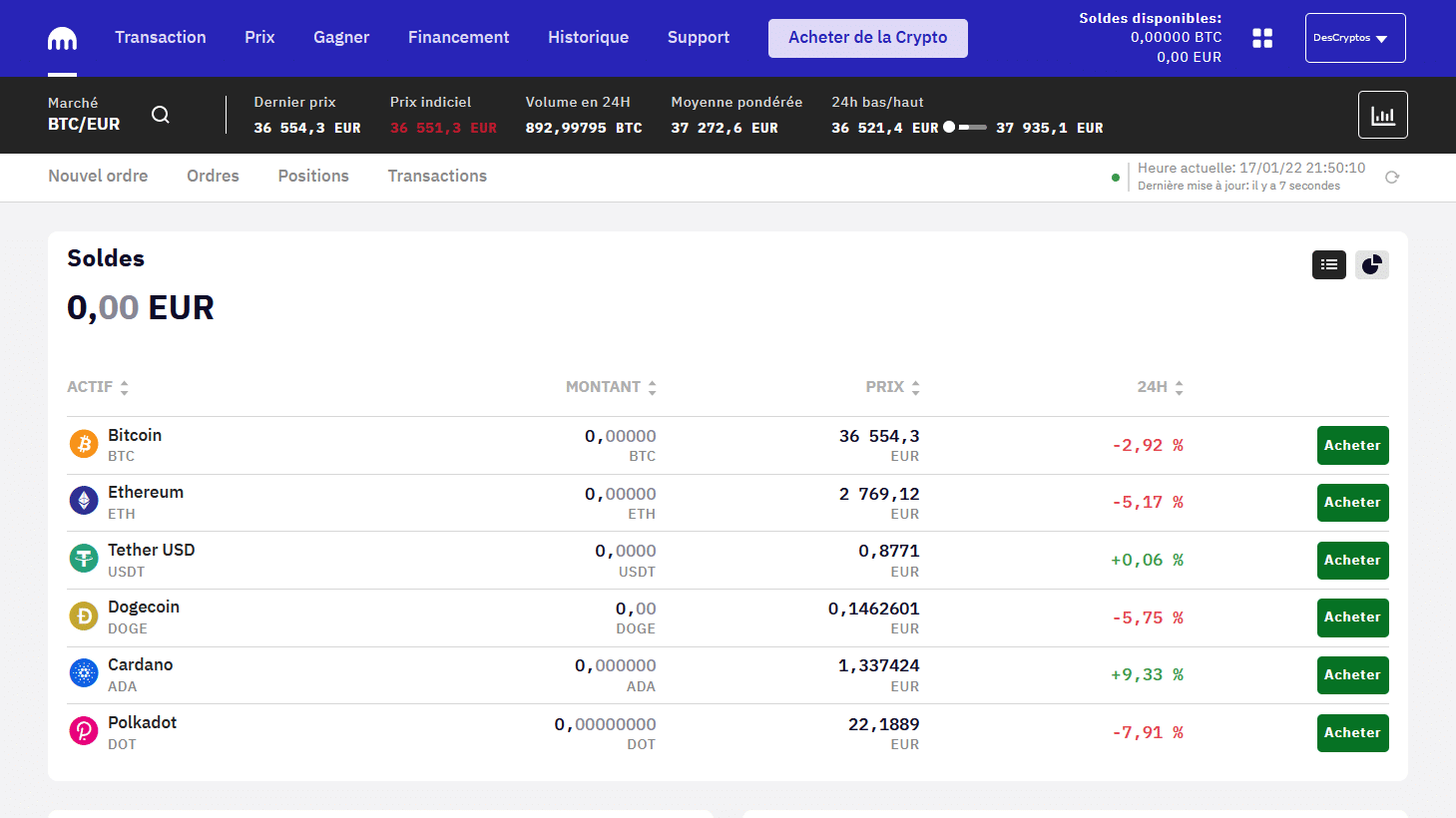

Web wallet

The last category of portfolios we will cover, and probably the most commonly used. Web wallets are only accessible via the Internet. They require no installation and are easy to use, beyond generally covering a wide range of cryptocurrencies.

Note, however, that you will not normally have access to your private keys. Indeed, your access to the wallet will be in the classic username/password form, with security steps such as two-factor authentication (2FA). Moreover, their nature makes them a prime target for hackers. It's rare for an attack to bear fruit and data to be stolen, but it's happened before. For this reason, we do not advise to use exclusively this type of wallet and store all your funds there. This applies especially if you want to invest for the long term.

The web wallets we approve:

How to create your crypto wallet?

You have now understood the theory, let's move on to practice! Creating a wallet usually follows a series of similar steps from one wallet to another:

- Download and install the wallet (for mobile and desktop wallet)

- Create an Account

- Build a strong password for your account

- Make sure that you use all the security systems offered by the wallet in question, such as questions and answers to set in case of forgotten password, or two-step authentication

- Complete the registration by sending the supporting documents requested as part of a registration to a wallet that also acts as an exchange platform.

Following these simple steps will allow you to get your first cryptocurrency wallet.

Which wallet to choose and how to protect it?

Beyond acquiring cryptocurrencies, it is essential to store your assets properly and securely.

We advise you to start simply by using the hot wallets mentioned earlier. Some exchanges offer their own wallets. Be sure to use usernames you won't forget and a complex and hard-to-find password that contains lowercase and uppercase letters, numbers, and special characters. In addition, make sure to use all the security available on the wallet you have chosen. This includes 2FA (two-factor authentication) or seed retrieval, a system for retrieving your identifiers with a succession of words that you have defined beforehand.

Once you have accumulated substantial funds, consider investing in a hardware wallet to transfer them to more secure storage.

Keep in mind that each cryptocurrency requires a different key. Wallets remain above all storage media for your private keys. Do not send your bitcoins to an Etherium address, and vice versa, otherwise your funds will be lost on the blockchain.

FAQ

In this section, we will cover frequently asked questions when creating and setting up crypto wallets.

Is a crypto wallet free?

Most wallets are free. The only wallets that generate an initial cost are hardware wallets, but they represent an interesting investment for anyone wishing to secure a certain amount of cryptocurrencies in the medium and long term.

How to liquidate the funds in your crypto wallet?

To liquidate your wallet, you will need to use an exchange, which is a cryptocurrency exchange platform. The most popular wallets usually have their own exchange platform, which makes it easy to exchange your cryptos into fiat currencies. Take special care when completing the information and fields necessary for a transaction (crypto public addresses, RIB …) in which case funds may be lost.

The procedure usually takes 10 to 15 minutes. If the transaction does not complete after a certain period of time, do not hesitate to contact technical support for more information. Usually a delay can be due to a temporary overload of the network in case of high demands.

Wallets/exchanges take a commission on each transaction which usually varies between 1% and 10%. This rate fluctuates depending on the currency used, the amount withdrawn, the withdrawal method, and a few other factors.

How to get a Bitcoin/Ether?

There are different ways to obtain digital currencies. Here we will discuss the two main ones:

The first will be mining.

The second will consist of buying crypto with a fiat currency (euros, dollars..) or swap (the exchange of one cryptocurrency for another).

You will find below, a widget proposed by Changelly which presents itself as a comparator for the purchase / swap of digital currencies at interesting rates.